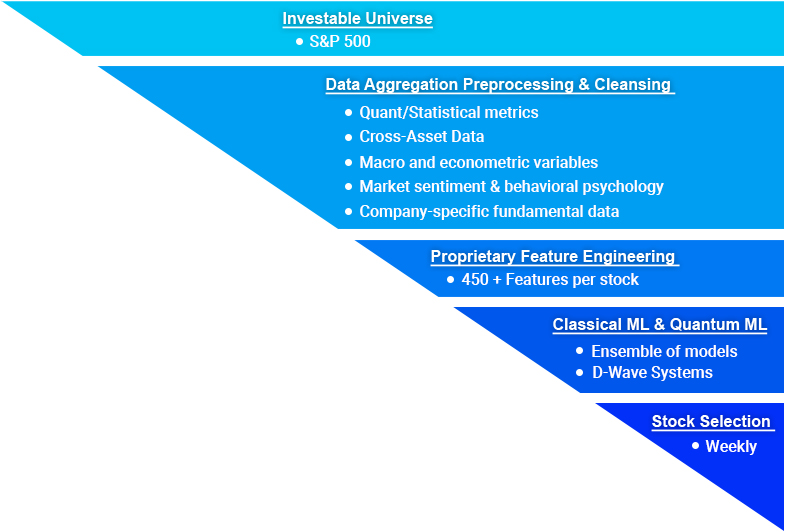

Investment Process

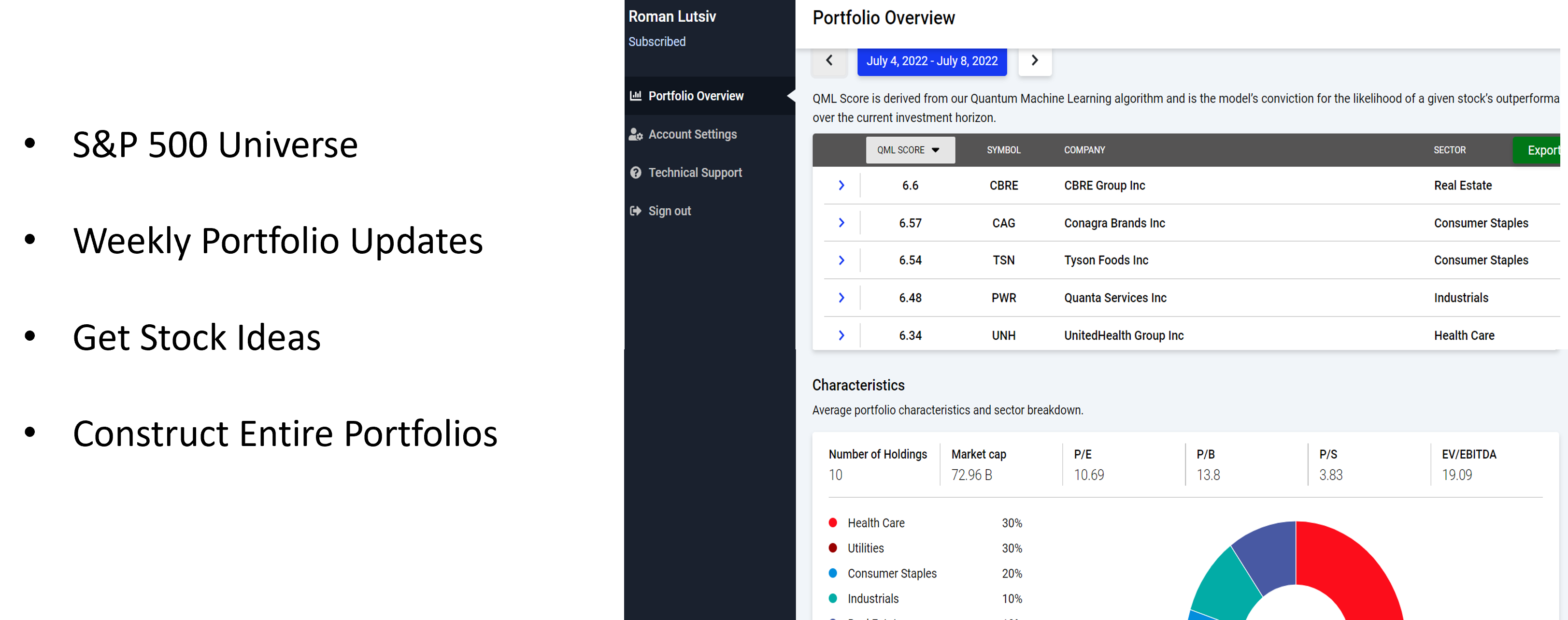

This process is underpinned by our proprietary hybrid framework, which fuses Quantum Computing with classical Machine Learning. We leverage D-Wave’s architecture, where a quantum machine learning algorithm is trained by a hybrid system involving both quantum annealing and classical optimization methods, in order to analyze thousands of data points and derive weekly portfolio selection.